*Risk Warning:Trading in Forex/ CFDs and other Derivatives is highly speculative and carries a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Domain usage rights belong to BDS Ltd.

BDS Ltd (Registration No. 8424660-1) is authorized and regulated by the Financial Services Authority (the “FSA”, licence no. SD047). Registered address: Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, Seychelles.

Viverno Markets Ltd (ex BDSwiss Holding Ltd) with registered address 6 Ioanni Stylianou, 2nd Floor, Flat/Office 202, 2003, Nicosia, Cyprus is acting as the payments processor for BDS Ltd.

BDS LTD does not accept clients residing in the following countries: Democratic Republic of Congo, Eritrea, Iran, Japan, Democratic People’s Republic of Korea, Libyan Arab Jamahiriya, Mauritius, Myanmar, North Korea, Seychelles, Somalia, Sudan, Syrian Arab Republic, United States (and US reportable persons), the United Kingdom and the EU. People with Cyprus/USA nationality are also excluded.

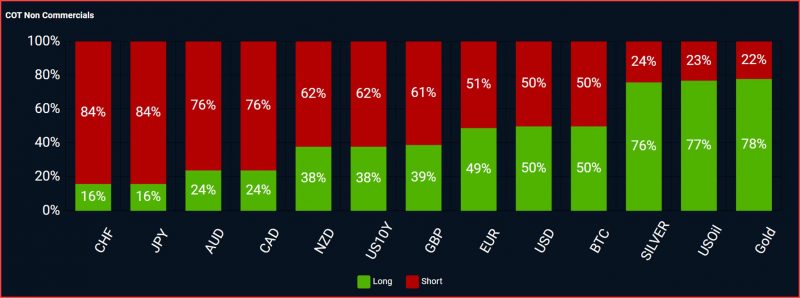

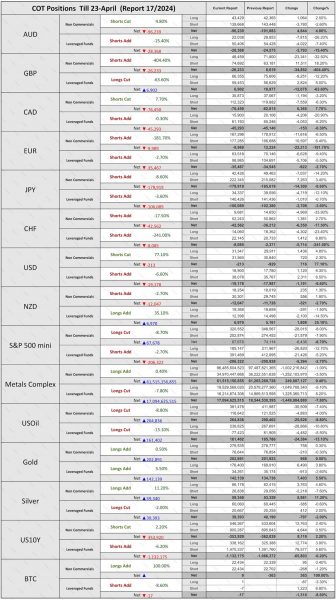

The below currencies saw an addition or cut in the non-commercials.

The below currencies saw an addition or cut in the non-commercials.