Technical Analysis Post

Amazon.com, Inc. (NASDAQ: AMZN) 2024 Q1 Earnings Release: Market Insights, Analyst Forecasts, and Technical Analysis

On April 16, 2024, Amazon.com, Inc. (NASDAQ: AMZN) revealed plans to host a conference call regarding its first quarter 2024 financial results on April 30, 2024, at 21:30 GMT.

The conference will be streamed live online, and both the audio and presentation slides will remain accessible for at least three months following the event at www.amazon.com/ir

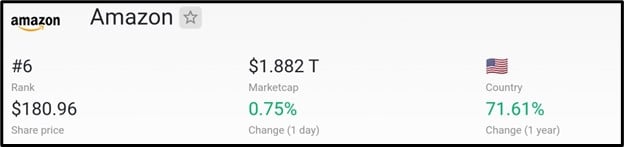

In April 2024, Amazon’s market capitalization stands at $1.882 trillion, ranking it as the sixth most valuable company globally based on market capitalization, as per data sourced from companiesmarketcap.com.

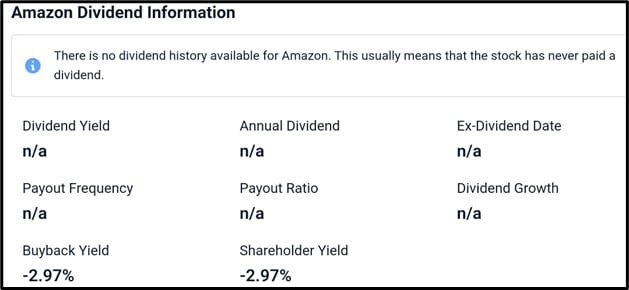

NASDAQ:AMZN Dividend Information

The information provided indicates that Amazon has no dividend history available, typically suggesting that the company has never paid a dividend. The dividend yield, annual dividend, ex-dividend date, payout frequency, payout ratio, dividend growth, and shareholder yield are all not applicable (n/a). However, the buyback yield is reported as -2.97%.

Recent Developments At Amazon

Amazon Invests $25 Million in Decade-Long AI Research Collaboration.

Amazon is committing $25 million to a decade-long research collaboration aimed at advancing AI. This initiative, in partnership with the University of Washington, the University of Tsukuba, and NVIDIA, will concentrate on AI research and workforce enhancement.

Amazon Empowers Sellers with Enhanced Generative AI Tools for Product Listings

Amazon’s selling partners now have access to additional generative AI functionalities to enhance their product listings’ quality. Amazon is enhancing its support for sellers by offering them the ability to link to their website and utilize new generative AI technology to effortlessly generate high-quality product pages within Amazon’s marketplace.

2023 Q4 Recap of Amazon Earnings Release

In the fourth quarter of 2023, net sales surged by 14% to $170.0 billion, marking a substantial increase compared to the $149.2 billion reported in the fourth quarter of 2022. This growth excludes the $1.3 billion favorable impact from year-over-year changes in foreign exchange rates, with net sales still showing a notable 13% rise over the same period in 2022. North America segment sales climbed by 13% to $105.5 billion, while international segment sales saw an even more impressive increase of 17% to $40.2 billion, or 13% when excluding changes in foreign exchange rates. Notably, the AWS segment also experienced robust growth, with sales jumping by 13% year-over-year to reach $24.2 billion. Operating income for the quarter skyrocketed to $13.2 billion, a significant increase from the $2.7 billion reported in the fourth quarter of 2022. Within this, North America segment operating income reached $6.5 billion, reversing the previous quarter’s operating loss of $0.2 billion. The international segment, however, faced an operating loss of $0.4 billion, an improvement from the $2.2 billion loss in the fourth quarter of 2022. Meanwhile, AWS segment operating income surged to $7.2 billion, compared to $5.2 billion in the same period last year. Net income also saw a substantial boost, reaching $10.6 billion in the fourth quarter of 2023, equivalent to $1.00 per diluted share. This marks a significant increase from the $0.3 billion net income, or $0.03 per diluted share, reported in the fourth quarter of 2022. It’s worth noting that the net income for the fourth quarter of 2023 includes a pre-tax valuation loss of $0.1 billion, stemming from the common stock investment in Rivian Automotive, Inc. This contrasts with the pre-tax valuation loss of $2.3 billion from the same investment in the fourth quarter of 2022.

2024 AMAZON Q1 Earnings Release Analyst Forecast

In the current quarter, sales estimates stand at a Zacks Consensus Estimate of $142.55 billion, derived from 16 estimations, with a range spanning from a high estimate of 144.45 billion to a low estimate of 140.70 billion, indicating a robust year-over-year growth estimate of 11.93% from the previous year’s sales of 127.36 billion. Conversely, earnings estimates depict a Zacks Consensus Estimate of 0.81, based on 13 estimates, with the most recent consensus at 0.70 and a range extending from a high estimate of 0.92 to a low estimate of 0.61, revealing an impressive year-over-year growth estimate of 161.29% from the previous year’s EPS of 0.31.

According to Investing.com, Amazon (NASDAQ: AMZN ) is expected to achieve an earnings per share (EPS) of $0.8445, with an estimated revenue of $142.65 billion.

Finally, according to TradingView.com, the anticipated earnings per share (EPS) for Amazon (NASDAQ: AMZN ) is projected to be $0.84, with an expected revenue of $142.65 billion.

Technical Analysis

From a technical analysis perspective using the 4-hour chart of (NASDAQ: AMZN), the stock has been exhibiting an uptrend since February 20, 2024. An uptrend line drawn from $165.38 initially resisted the price at $171.30 following a retracement from $180.21. Subsequently, the price resumed its upward trajectory, reaching $189.74, before reversing to $166.37 subsequent to breaching the uptrend line to the downside. Presently, the price hovers around $180.98, aiming towards the uptrend line. A break above the uptrend line suggests a higher likelihood of further upward movement, while rejection by the uptrend line implies a higher probability of downward movement.

Conclusion

In conclusion, Amazon.com, Inc. (NASDAQ: AMZN) is set to host a conference call today, to discuss its first-quarter financial results, which are eagerly anticipated given the company’s recent performance and strategic initiatives. With a market capitalization of $1.882 trillion, Amazon holds a significant position in the global market. While the company has not historically paid dividends, its focus on research collaborations and AI tools for sellers underscores its commitment to innovation and growth. The recent earnings release for the fourth quarter of 2023 showcased impressive growth across segments, with notable increases in net sales and operating income. Looking ahead, analyst forecasts for the first quarter of 2024 indicate continued growth, with strong estimates for both sales and earnings. Additionally, technical analysis suggests a positive uptrend in the stock’s performance since February 20, 2024, with potential for further upward movement if the uptrend line is breached to the upside. Overall, Amazon’s upcoming earnings call and strategic endeavors position it for continued success in the evolving market landscape.

Sources

https://companiesmarketcap.com/amazon/marketcap/

https://stockanalysis.com/stocks/amzn/dividend/

https://www.aboutamazon.com/news/innovation-at-amazon/amazon-generative-ai-powered-product-listings

https://www.google.com/amp/s/www.benjamindada.com/amazon-south-africa-launch-2024/amp/

https://www.zacks.com/stock/quote/AMZN/detailed-earning-estimates

https://www.investing.com/equities/amazon-com-inc-earnings